The Long Term Care Risk - Put Yourself in Their Shoes

Vince and Barbara Farone are just like you.

In many ways they were a typical American couple. A love affair between Yankee and Southerner, the Farones married in 1965 and later retired to Murfreesboro, Tennessee. Having worked in the nursing home industry, Barbara appreciated the value of long term care coverage and convinced them both to purchase policies in 1997.

Although Barbara had suffered a heart attack and been diagnosed with brain cancer, steadfast Vince was the kind of fellow you'd call "healthy as a horse." It's Vince we're going to focus on...

Just four years after receiving their LTC policies, Barbara began to notice subtle changes in Vince.

His hands started to shake ever so slightly. He began to turn his words around.

Over the course of the next four years, a rare degenerative nerve disorder gradually took hold, robbing Vince of his speech and muscular control until he could no longer walk nor feed himself.

Even when the most Vince could do was chew and swallow, his long term care policy allowed him to stay at home until the end. Rather than care for him, his wife was able to care about him. With the help of their wonderful provider, Barbara took Vince to many of their favorite destinations.

Because they planned ahead, the Farones gave themselves choices, and Vince lived-- and died-- with dignity.

Theirs is a true story. You needn't believe us. Hear Barbara in her own words.

Who Will Need Care?

This year, about 9 million Americans over the age of 65 will need extended care. By 2020, that number will increase to 12 million. Most long term care claims are filed for dementia (the loss of cognitive functioning such as thinking, remembering and reasoning) than for any other cause, and these claims are also the longest and most expensive. Although there are dozens of types of dementia, Alzheimer's disease is the most prevalent, affecting an estimated 5 million Americans.

While most people who need long term care are over age 65, a person can require LTC services at any age. In fact, it is estimated that forty percent (40%) of people currently receiving long term care are adults 18 to 64 years old.

What are Your Chances?

According to the latest research on the topic, 1 out of every 2 of us will need some long term care. Twenty-seven percent (27%) can expect to spent at least $100,000, while fifteen percent (15%) can expect costs greater than $250,000.

How do you know which kind of future you'll have? Factors that increase your risk of needing long-term care include:

- Age - your risk generally rises as you get older

- Marital Status - singles generally lack a robust social support system and are more likely to rely on paid care

- Gender - women are at greater risk than men, not only because they tend to live longer, but also to live alone

- Lifestyle - health history, poor diet and exercise habits can increase your risk

- Family History - genetics may be a predictor of future predispositions

- The average length of claim is around three years.

- Women tend to claim longer (3.7 years avg) than do men (2.2 years avg).

- While many of today's adults may never need LTC services, twenty percent (20%) will need care for more than five years.

You may never need care. You may be one of the lucky ones. But if you're not... the consequences to your family could be devastating.

When is the Best Time to Buy LTC Insurance?

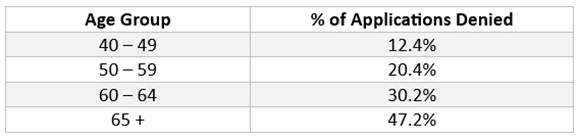

You may have heard the expression, "Money pays for insurance, but health buys it." Many families researching this solution don't appreciate how the acceptance rate falls as we age. The chart below illustrates how the age at which you apply can impact your eligibility. Not only does it reinforce the importance of starting the planning process sooner rather than later, but the importance of working with a producer with access to a deep bench of solutions, and a veteran's familiarity with each carrier's underwriting preferences. In other words, working with LTCA:

Content on this page derived in part from the National Clearinghouse for Long-Term Care and the American Association for LTC Insurance.